The best crypto prop firms in 2025 are FundedNext, FTMO, BrightFunded, HydroTrader, Funded Trading Plus, The Trading Pit, DNA Funded, and Apex Trader Funding. Basically, these companies fund you with their capital to trade cryptocurrencies after you prove yourself in a trading challenge, and then, in exchange, you keep a profit split (often 80-90% of your profits) while they cover losses.

In this guide, you’ll find a quick overview of the top 8 best crypto prop firms, how crypto prop trading works, the pros and cons, and tips on choosing and joining the right program for you.

1. FundedNext

FundedNext is a popular prop firm that expanded from forex into crypto trading. It’s generally known for flexible funding models and a high profit split. Well, their biggest selling point is that they give you a 95% profit split and a 15% split just from the challenge phase on most of their plans.

FundedNext gives you access to some of the major trading platforms (MT4, MT5, cTrader, etc.), and the firm is pretty global, so it doesn’t matter whether you’re trading from New York or New Delhi.

Key Features of FundedNext

- Profit Split: Up to 95% (performance-based)

- Trading Platforms: MT4, MT5, cTrader, Match-Trader

- Challenge Type: Two-phase evaluation or instant funding program

- Account Sizes: Up to $200,000 (scaling possible to ~$4 million)

- Available Cryptos: Major pairs (BTC, ETH, etc. via CFD)

- Leverage: Up to 1:100 on forex (crypto trades at lower leverage, ~1:1)

- Payouts: Bi-weekly withdrawals once funded

Pros of FundedNext

- Get a 15% profit share from the challenge phase

- No time limits on your evaluation

- High profit split, going up to 95%

- Multiple supported platforms (MT4, MT5, cTrader)

Cons of FundedNext

- Crypto leverage is pretty low, often around 1:1 only

- The 15% challenge payout is not available on all account types

- Only supports 9 crypto trading pairs

2. FTMO

FTMO is basically the gold standard of prop firms. It started with forex, but now lets you trade crypto as well. You can trade over 10 different crypto pairs, including Bitcoin, Ethereum, and Litecoin. Also, their reputation for reliability and professional payouts is another huge plus.

Before, FTMO used to have a 30-day time limit, but they removed it. Now, you have unlimited time to complete your FTMO challenge and verification part. Generally, they offer two main account types: Standard and Aggressive. The Aggressive one has quite high profit targets and higher drawdown limits too.

Key Features

- Profit Split: 80% standard (90% after achieving milestones)

- Trading Platforms: MetaTrader 4 and 5 (proprietary web trader available)

- Challenge Type: Two-phase evaluation

- Account Sizes: Up to $200,000 initial (scaling plan can grow accounts further)

- Available Cryptos: Key crypto CFDs (BTC, ETH, etc., not a wide variety)

- Leverage: Up to 1:100 on forex (crypto typically 1:1 or very low leverage)

Pros

- One of the most reputable prop firms in the world

- Unlimited time for your challenge

- Great platform choice (MT4, MT5, cTrader)

- Profit split scales up to 90%

Cons

- The starting price ($10,000) is a bit higher than some competitors

- Limited number of supported cryptocurrencies and their leverage

3. BrightFunded

BrightFunded is another newer player that is getting a lot of attention, and that’s because of its payout speed. Actually, they promise an average payout processing time of just 4 hours. Also, for crypto traders, they even support payouts directly in the USDC stablecoin.

BrightFunded’s standout feature is that you get an unlimited scaling plan and the Trade2Earn loyalty system. So, every time you trade (may be win or lose), you gonna earn points toward perks like free retry challenges or higher payouts. They run a 2-phase evaluation challenge, similar to FTMO, so you have to pass two stages to get your funded account.

Key Features

- Profit Split: 80% starting, up to 100% for top performers

- Trading Platforms: cTrader and BrightFunded’s own web platform (desktop & mobile)

- Challenge Type: Two-phase evaluation (reasonable profit targets)

- Max Capital: $400,000 funded account per challenge (with potential to expand beyond via scaling)

- Available Cryptos: ~40+ cryptocurrencies (from Bitcoin & Ethereum to various altcoins and even meme coins)

- Leverage: Up to 5:1 on crypto trades

Pros

- Super-fast 4-hour average payout time

- Payouts available in USDC crypto

- Profit split can go up to 100%

- Unlimited time to pass the evaluation

Cons

- A bit newer firm, so less long-term reputation than FTMO

- The firm prohibits certain strategies, including high-frequency bots

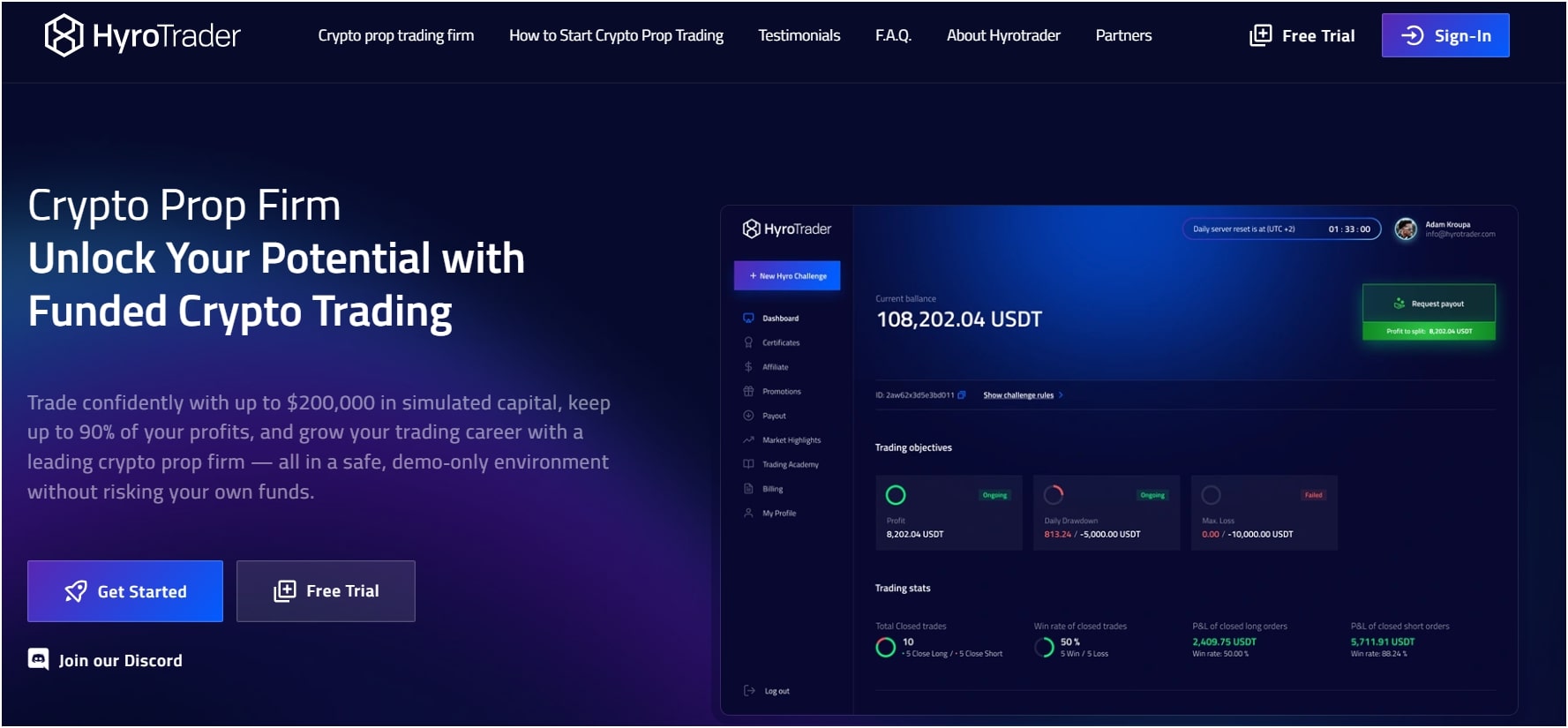

4. HyroTrader

HyroTrader is one of the best crypto prop firms for a very good reason: it lets you trade on real crypto exchanges. You can even connect the best crypto exchanges like Bybit using APIs. You know, this setup builds a lot of trust since you won’t get weird price spikes or “off-market” quotes.

They offer fast and on-demand payouts in less than 24 hours and send them directly in USDT or USDC. Also, their profit split starts a little lower, at 70%, but yes, it scales up to 90% as you prove your consistency. Well, the best beginner-friendly feature is their refundable fee. So here, you pay for the challenge up front, but once you pass and get your first profit payout, your basic fee is paid back to you. It’s 100% paid back.

Key Features

- Profit Split: 70% to start; can scale to 80% and 90% with consistent profits

- Trading Platform: Integrated with Bybit

- Challenge Type: One-phase evaluation

- Account Sizes: Up to $200,000 starting funded account (with potential scaling up to $1,000,000 for top traders)

- Available Cryptos: All major coins and many altcoins available on Bybit (read our full Bybit review)

- Leverage: High leverage available (up to 1:100 on some crypto futures, per exchange limits)

- Payouts: On-demand in crypto (USDT/USDC), typically processed within 24 hours

Pros

- A specialist firm focused on cryptocurrency

- Extremely fast crypto payouts (USDT/USDC)

- Unlimited time for your evaluation

- Good scaling plan for consistent traders

Cons

- The starting profit split is lower (70%) compared to others

- Likely fewer non-crypto assets to trade

5. Funded Trading Plus

Funded Trading Plus (FTP) is a UK-based prop firm. Well, their main attraction is the choice of challenge types. So, you can basically choose a 1-step, 2-step, or even an “Instant Funding” program, where you’re going to skip the challenge.

The profit split is solid at 80%, and you can upgrade it to 90% (or even 100% on paper trading profits) as you achieve certain milestones. Also, cryptocurrency trading is fully supported on all kinds of account types, and guess what: no commissions on crypto trades.

Key Features

- Profit Split: 80% standard; can increase to 90% (and even 100% in demo phase rewards)

- Account Sizes: $5,000 – up to $200,000 initial accounts

- Challenge Types: One-phase challenge (10% target), Two-phase challenge (8% then 5% targets), or Instant funding (no challenge, start at 80% profit share)

- Available Cryptos: Major crypto pairs like BTC/USD, ETH/USD, LTC/USD, BCH/USD

- Leverage: Generally up to 1:30 on most assets (crypto is effectively leverage-free to reduce risk)

- Trading Platforms: MT4, MT5, cTrader, Match-Trader, DXtrade

Pros

- Multiple program types (1-step, 2-step, instant)

- Very high profit split, up to 90%

- Fast payouts every 7 days

- Strong, positive reputation in the community

Cons

- Instant Funding programs have tough drawdown rules

- Crypto leverage is very low

6. The Trading Pit

The Trading Pit is a prop firm that puts a big emphasis on transparency, regulation, and multi-asset trading. They are based in Liechtenstein. Also, they offer challenges not just for crypto, but also for forex, futures, stocks, etc., so it’s truly multi-asset.

The profit split ranges from 70% to 80%, and yes, this is slightly lower than some competitors, but still fair given the other benefits. Generally, they use a multi-step evaluation process. So, in practice, this means you pass an initial challenge and then often operate as a “signal provider” in a second phase to prove consistency before full funding.

Key Features

- Profit Split: 70% starting, up to 80% at higher account tiers

- Challenge Structure: Two-step process for most

- Leverage: Up to 1:20 on CFD trading challenges (crypto and other assets included)

- Account Options: Challenges from €5,000 accounts up to €200,000+ (with scaling to multi-million via a tiered growth plan)

- Platforms: QuantTower and MetaTrader offered, plus direct futures exchange access (for CME, etc., in futures challenges)

- Payouts: Weekly profit withdrawals

Pros

- Good regulatory background (based in Liechtenstein)

- Offers a very wide range of assets

- Solid profit split up to 80%

- Multi-step evaluation ensures consistency before scaling up

Cons

- Crypto trading options are present, but not the widest range

- They may be less focused on beginners

7. Apex Trader Funding

Apex Trader Funding is a specialist, and they are not like the other firms on this list. Mostly, Apex specializes in futures trading. So, you are not trading crypto CFDs. You are trading crypto futures contracts, like the Micro Bitcoin Futures (MBT), on the Chicago Mercantile Exchange (CME).

Their funding model is also different, as it is a 1-step evaluation. Also, you just have to hit a profit target without hitting a trailing drawdown. There are no time limits. But you pay a monthly fee for the evaluation, not a one-time refundable fee. And, once you pass, you keep paying a monthly data fee, but you get a massive payout: 100% of your first $25,000 in profits, and 90% after that.

Key Features

- Profit Split: 90% (in some programs, the first few payouts can even be 100% in promotions)

- Evaluation: Typically one-phase evaluations

- Account Sizes: Ranges from $25,000 accounts to $250,000+

- Available Cryptos: Focus on Bitcoin, Ethereum, and top crypto assets via futures contracts (and major forex, indices, commodities for non-crypto trades)

- Leverage: Very high effective leverage since you’re trading futures contracts

- Trading Platforms: NinjaTrader, Tradovate, Quantower, etc., plus some web interfaces. No MT4/MT5 here.

Pros

- The best choice for trading crypto futures

- 100% profit split on the first $25,000

- Simple 1-step evaluation

- Uses the professional NinjaTrader platform

Cons

- Platform choices can be complex for beginners (uses pro software like NinjaTrader)

- You pay a monthly fee, not a one-time fee

8. DNA Funded

DNA Funded is one of the newer names in the prop trading industry. Now, unlike firms that only let you trade futures, DNA Funded is all about Forex, commodities, indices, and crypto CFDs, and gives you access to over 800 different financial instruments.

Their funding model is also designed to be super trader-friendly to all traders worldwide. You can pick between a quick one-step challenge, a more standard two-step evaluation, or even a 10-day sprint if you’re confident. Well, the big win here is that the main challenges usually have no time limits, and the fee you pay is a one-time charge, which is nice compared to a subscription model.

Key Features

- Profit Split: Up to 90% (80% default, can be increased with an add-on)

- Trading Platforms: TradeLocker

- Challenge Type: 1-Step, 2-Step, and 10-Day Evaluation options

- Price: One-time evaluation fee (e.g., $59 for a $5,000 account)

- Maximum Capital: Up to $600,000

- Available Cryptocurrencies: Crypto CFDs (part of 800+ assets)

- Leverage: Varies by challenge, up to 1:50

Pros

- One-time evaluation fee, not a recurring monthly charge

- Massive selection of tradable assets, including Forex, Indices, and Crypto CFDs

- Very high profit split, up to 90% for successful traders

- No time limits on the standard evaluation phases

Cons

- The firm is newer, so it doesn’t have the long track record of some competitors

- Uses the TradeLocker platform, which may be unfamiliar to traders used to MT4/MT5

What Is a Crypto Prop Firm?

A crypto prop firm is a company that gives you capital to trade cryptocurrencies. Here, “Prop” is short for proprietary trading. Basically, you are trading the firm’s money, not your own. Generally, you first have to pass a test (called a challenge or evaluation) to prove you are a good trader, and once you pass that one, they give you a funded (but simulated) account, and you split any profits you make, often around 80/20 or 90/10 in your favor.

So, how are they different from forex or stock prop firms? The main difference is the market only. You know, crypto markets are open 24/7/365 and are much more volatile. Hence, crypto proprietary trading firms build their rules around this. Also, they might have different leverage rules, and they must have platforms that can handle volatile prices of digital assets like Bitcoin and Ethereum. In short, you are actually a crypto-funded trader working with their capital.

How Do Crypto Prop Trading Firms Work?

Crypto prop trading firms generally work through a very structured evaluation and funding process designed to find good, skilled traders and then back them with money. While each firm has its own twist, the general workflow is:

- Challenge Phase: You need to pick an account size (like $10,000 or $100,000) and pay a one-time fee. But this one is generally a refundable fee.

- Evaluation Phase: Then, you have to trade in a demo account and have to hit a profit target (e.g., 8% profit) without breaking any rules. Now, the most important rule here is the “drawdown” (e.g., do not lose more than 5% in one day or 10% total).

- Funded Account: After you pass, the firm is going to give you a “funded” account, and you will also get your challenge fee refunded with your first profit split.

- Trade and Get Paid: Finally, you need to trade the funded account (which is still a demo account connected to real money) and follow the rules. At the end of the payout period (e.g., weekly or bi-weekly), you request a payout, and the firm sends you your profit split (e.g., 80% of the profits) and keeps its 20%. Hence, this model lets you trade a large crypto-funded account without risking any of your own money, of course, except for the initial challenge fee.

What Are the Pros and Cons of Crypto Prop Firms?

The pros of crypto prop firms are access to large capital, high profit potential, risk management training, no personal losses, and access to a 24/7 crypto market globally.

The cons of crypto prop firms are initial assessments, strict trading rules, firm reliability, and some hidden costs.

Pros of Crypto Prop Firms

- Access to Trading Capital: You can easily trade with a big account funded by the firm instead of your own limited funds. It is way easier for a skilled trader to use a $100,000 account from a firm than to somehow scrape together $100k himself.

- High Profit Potential: You know, with the splits being 80-90% in your favor often, you keep the majority of what you bring in. So, if you have a great month and make $5,000, you might take home $4,000 of that.

- Risk Management Training: The evaluation rules, like drawdown limits and profit targets, force you to trade responsibly. Here, many traders actually improve their strategy and risk management just by attempting prop firm challenges because you must cut bad habits, like revenge trading or not using stop losses.

- No Personal Losses: Again, if you blow up a funded account within the defined limits, you don’t owe the firm for those losses. You might lose your spot with the firm, but you’re not in debt. Hence, the worst-case scenario is that you lose the evaluation fee, or you have to start over.

- Global and 24/7 Opportunities: Crypto prop firms often take in successful traders from all over the world and allow you to trade 24/7 crypto markets. Crypto firms are very accessible, whereas some stock prop firms may require you to be in a specific location or trade at certain hours. You could be in Asia, Europe, or the Americas, and you can join and trade around the clock.

Cons of Crypto Prop Firms

- Assessments: It is not easy to pass the first challenge, as many applicants, in fact, fail on the first attempt. You are expected to reach fairly ambitious profit targets without breaking any of the predetermined rules.

- Strict Trading Rules: Even when your account is funded, you are not yet totally free. The firms impose ongoing rules on you: maximum daily loss, overall drawdown, and sometimes limits on holding trades over weekends or during big news events. There may also be banned trading strategies; for example, no martingale, no arbitrage, etc. Also, you might lose your funded account on the spot if you break even one of those rules by mistake.

- Firm Reliability: You know, not all prop firms are created equal, and a few of them have had issues with payout delays, changes in rules, or even shutdowns in the crypto prop space. So, if a firm is undercapitalized or has poor management, you could experience problems when trying to withdraw your profits.

- Costs and Fees: Other than the evaluation fee, some firms even charge monthly data fees, withdrawal fees, or have other hidden costs. All these little costs mean you need to perform that much better to net the same profit.

How to Choose the Right Crypto Prop Firm?

To choose the right cryptocurrency prop firm, you need to check factors such as evaluation rules, supported exchanges, profit and payout policy, leverage rules, fees, and the firm’s reputation.

- Evaluation Rules & Difficulty: You need to check the challenge requirements. So, if you’re a complete beginner, you may want a firm that has a one-step evaluation or, if necessary, easier rules, such as a lower profit target and no time limit.

- Supported Platforms & Exchanges: You can check what trading platforms are available and how the trading is executed. Also, if you love TradingView or MT5, make sure the firm offers it. Some firms integrate with actual crypto exchanges or use certain brokers; for example, a firm might connect you to Binance or use liquidity from OKX.

- Profit Split & Payout Policy: Obviously, the higher the profit split, the better for you, but also consider payout frequency and methods. A firm that offers an 85% split but only pays out monthly might not be as good as one with 80% that pays weekly. So, check the reviews to be able to assure they actually pay on time with your favorite method, whether it’s crypto, PayPal, bank, etc.

- Leverage and Instruments: Most of the cryptocurrency firms have different leverage caps. Now, if you need high leverage to perform your scalping strategy, find a firm that offers it; some go 5:1 or more on crypto, while others stick to a lower one. Also, check the instruments: do they offer just crypto CFDs or also crypto futures? How many crypto pairs? If you want to trade a variety like Dogecoin, Solana, etc., make sure they’re available.

- Fees & Pricing: You have to find out how much the review fee and all recurring costs are. One firm’s $100,000 challenge may cost $500, while another’s costs $349 for similar parameters. Also, you need to see if fees are refundable; many refund your fee once you’re funded and get a payout. Plus, watch out for any monthly fees or data charges.

- Reputation & Trustworthiness: This one is huge and most important. Do your research about the firm’s track record; read trader reviews and check out discussions in communities like Reddit or Discord. Generally speaking, a firm that has been around longer and has verifiable payout proofs is generally safer.

How to Join a Crypto Prop Trading Firm?

Step 1: Research and Choose a Prop Firm

You need to pick which prop firm you would want to apply for, using the tips in the prior section, of course.

Step 2: Sign Up and Pay the Fee

Once you have become comfortable, create an account on the website of the firm. You’ll likely need to provide an email and some personal information. Then you need to select the evaluation challenge you want, for example, a $50k crypto account challenge: one-phase or two-phase. Next, continue to checkout and make the fee payment for that challenge.

Step 3: Prepare Your Trading Plan

Before you place a single trade on the evaluation, have a plan. Know the rules (max lot size, which cryptos are allowed, etc.) and set your own risk per trade so you don’t hit the drawdown.

Step 4: Trade Through the Evaluation

Start trading in accordance with the firm’s rules. You have one focus: to pass the challenge, not by betting the house but by being consistently profitable. So, stick to your strategy, keep losses small, and do not violate any rules.

Step 5: Full Agreements & Verification

After the evaluation, the company will send you a contract or agreement to sign as an independent trader; read and sign it, of course. Sometimes, you also have to verify your identity with an ID and proof of address, a standard procedure to avoid fraud and comply with the law.

Step 6: Begin trading the Funded Account

Once the paperwork is completed, the company will open a live account for you or a simulated account that mirrors a live account. Now you are trading with real money. Keep following the rules, and your objective now is steady profits without any big drawdowns.

Step 7: Withdraw Profits & Scale Up

This is pretty standard, where you go into a portal and click a “Withdraw” button, selecting your method: crypto transfer, bank, whatever. Next, from that point onward, continuous trading and scaling when possible.

Which Are the Best Crypto Prop Trading Firms for Beginner Traders?

The best crypto prop trading firms for beginner traders are FundedNext or FTMO. The main reason is their “no time limit” rule on challenges. You know, as a beginner, the worst thing you can do is force bad trades to meet that 30-day deadline. But here, with unlimited time, you can relax, wait for good setups, and trade your plan correctly.

Also, they both use a 2-step challenge, which is good for learning, and the rules are clear (e.g., 5% daily loss, 10% total loss), and it teaches you the discipline you need. Plus, FundedNext even offers a 15% profit share from the challenge, which is another nice bonus.

Which Is the Best Prop Firm to Trade Futures?

The best prop firm to trade futures is Apex Trader Funding. They are quite specialists in this area, and they also give you access to the professional NinjaTrader platform and connect you to regulated exchanges like the CME. You can easily trade crypto futures like Micro Bitcoin (MBT) and Micro Ether (MET).

Conclusion

In summary, a crypto prop trading firm is basically a company that stakes its own money on your trading skills and then gives you a larger account to trade cryptocurrencies in exchange for a share of the profits. The top crypto proprietary trading firms on this list, like FundedNext and FTMO, offer fantastic, reliable paths for new traders.

So, what’s next? You need to choose the firm that best suits your trading style and give that evaluation a shot. Also, you should start your funded trading journey with one of these trusted crypto prop firms.